VA disability payments are monthly, tax-free monetary benefits paid to veterans with service-connected disabilities. These benefits are intended to compensate them for the impact of their medical conditions on everyday life, work, and personal well-being. Compensation is determined through a disability rating system, where each military service-connected condition is assessed and assigned a percentage from 0% to 100% based on its severity.

When you finally succeed in proving to the VA that your disability or disabilities are service-connected, you must receive the correct compensation, especially if you have dependent children. However, VA disability rates can be complicated to determine because so many different factors influence the amount you receive each month.

Key Factors Affecting VA Disability Pay Rates for Veterans with Dependent Children

Your base VA disability pay rate isn’t a straightforward calculation. Several elements impact the amount you’re entitled to, including:

- Total VA Disability Rating: The VA assigns each service-connected disability a percentage rating based on the severity of the condition and its impact on your daily life and ability to work. Ratings are given in 10% increments and reflect the degree of disability the VA recognizes in each condition. A higher overall rating means a larger monthly compensation amount.

- Year and Month of Benefit Payment: The VA updates pay rates each year to reflect annual cost-of-living adjustments (COLA increase), which the Social Security Administration uses to account for inflation and changes in the economy. These adjustments typically occur in December, with new disability rates taking effect for benefits paid in January of the following year. Each year’s rates vary, and backdated disability compensation benefits for previous years follow the rate that was in place for that specific period.

- Dependent Status: VA disability pay rates increase if you have dependents, which include a spouse, dependent children, and, in some cases, dependent parents. Each dependent child can increase your monthly payment.

To avoid receiving less than you’re entitled to, make sure you’re rated appropriately for all service-related conditions. Accurately reporting and verifying dependent status with the VA is also necessary to secure higher pay rates for disabled veterans with dependents, including children.

VA Disability Compensation and Dependents

The VA recognizes that veterans with service-connected disabilities who have dependents may face additional financial challenges. Veterans with a combined disability rating of 30% or higher qualify for an increase in their monthly pay based on the number and type of dependents they have. This additional compensation helps veterans support their families while managing the impact of their service-related disabilities.

Generally speaking, eligible veterans receive additional compensation for each dependent child. The rate increases with each additional child under age 18. Children aged 18 to 23 also qualify if they’re attending a VA-approved educational institution. Veterans must submit proof of enrollment each year to ensure they receive these additional benefits.

If a child has a permanent disability established before age 18 that renders them incapable of self-support, they can qualify as a dependent indefinitely, regardless of age. This allows veterans to continue receiving additional compensation for these dependents as long as the child’s condition remains unchanged.

Additional Pay Rates for Veterans with Dependent Children

As explained earlier, the VA offers a baseline increase in monthly compensation for veterans with dependent children. As of the latest update, here’s a look at how this works:

- If the veteran has a 30% disability rating and only one child (no spouse or other dependents), the monthly compensation amount is $565.31.

- For veterans with higher disability ratings, the monthly compensation increases accordingly:

- 40% Rating: $810.28 per month

- 50% Rating: $1,144.16 per month

- 60% Rating: $1,444.88 per month

- 70% Rating: $1,813.28 per month

- 80% Rating: $2,106.01 per month

- 90% Rating: $2,366.91 per month

- 100% Rating: $3,877.22 per month

Additional Benefits for Multiple Children

For each additional child under the age of 18, the veteran’s monthly compensation increases. This amount varies by the veteran’s disability rating. For instance:

- At a 30% rating, each additional child under 18 adds $31.00 to the monthly compensation.

- At a 40% rating, each additional child under 18 adds $41.00.

- At a 50% rating, each additional child adds $51.00.

This increment rises with each 10% increase in disability rating.

This means that veterans with two or more dependent children will see higher monthly compensation to support their growing families, and the rate for each child scales up with the veteran’s overall rating.

Children Aged 18-23 in School

Children who are aged 18-23 and are enrolled in an approved educational institution also qualify for dependent benefits, although at a higher rate than children under age 18. The VA recognizes that children attending college or vocational training incur additional expenses, so the compensation increases for these dependents to help with educational costs.

Here’s a look at the monthly rates for children aged 18-23 who are enrolled in school:

- 30% Disability Rating: Veterans with a 30% rating receive an additional $100.00 per child aged 18-23 enrolled in an approved educational program.

- 40% Disability Rating: Adds $133.00 per child.

- 50% Disability Rating: Adds $167.00 per child.

- 60% Disability Rating: Adds $200.00 per child.

- 70% Disability Rating: Adds $234.00 per child.

- 80% Disability Rating: Adds $267.00 per child.

- 90% Disability Rating: Adds $301.00 per child.

- 100% Disability Rating: Adds $334.49 per child.

Veterans need to provide proof of the child’s enrollment in a VA-approved educational institution annually to ensure this additional benefit is applied. They should also notify the VA promptly if the child discontinues education or no longer meets the age requirements to avoid overpayments.

Helpless Children (Permanently Incapable of Self-Support)

For children who are permanently incapable of self-support due to a disability that was established before the age of 18, the VA offers continuous dependent benefits. These children, referred to as “helpless children,” may qualify for additional compensation indefinitely, regardless of age, as long as they remain unmarried and unable to support themselves. Veterans must provide medical records that demonstrate the child’s severe disabilities to the VA.

The added monthly amount for helpless children depends on the veteran’s disability rating and is similar to the rates for children under 18, but the exact amount may vary based on individual circumstances. Since these disabled children do not age out of benefits eligibility, veterans should work closely with the VA to ensure all necessary documentation and medical evidence are up to date.

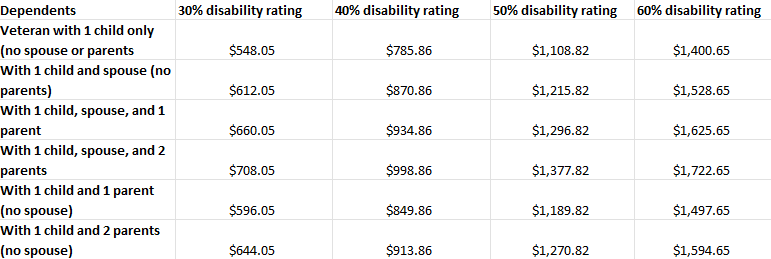

Compensation Benefits Rate Table for 30% to 60% Disability Rating

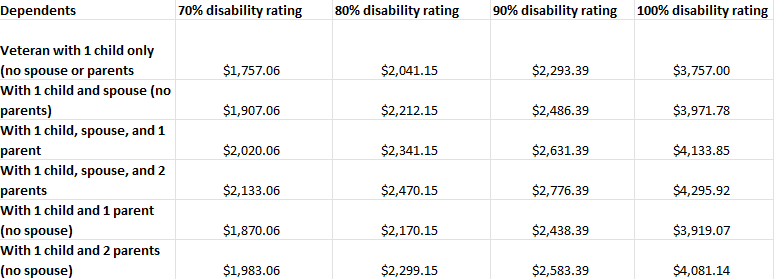

Compensation Benefits Rate Table for 70% to 100% Disability Rating

Qualifying as a Dependent Child for VA Disability Benefits

Dependent children of veterans may qualify for additional VA disability compensation if they meet specific criteria concerning their relationship with the veteran, marital status, age, and disability (the latter referring to helpless children).

Relationship to the Veteran

To qualify as a dependent, the child must be one of the following:

- Biological Child: A child born to the veteran. Proof of relationship is typically established through a birth certificate listing the veteran as a parent.

- Adopted Child: An adopted child qualifies as a dependent once the legal adoption is finalized. Veterans must provide adoption papers as proof of the relationship.

- Stepchild: A stepchild is eligible as long as they live in the veteran’s household, and the veteran is married to the child’s biological or adoptive parent. If the veteran’s marriage to the child’s parent ends, the stepchild may lose dependent status unless the veteran adopts them legally.

The relationship requirement is fundamental because the VA considers dependent benefits an extension of the veteran’s responsibility to financially support close family members. Each relationship must be documented, so veterans should ensure they have the proper dependency records on file with the VA. Speak to your regional office or a VA disability attorney if you have questions.

Marital Status of the Child

Eligibility requirements state that a dependent child must be unmarried to qualify for additional compensation. This helps ensure that dependent benefits are directed toward children who rely primarily on the veteran’s support. However, there are specific cases in which a child may still qualify if their marital status changes:

- Annulled Marriages: If a child’s marriage is legally annulled, meaning it was declared void from a legal standpoint, the child can regain dependent status. In this situation, the VA will require the annulment documentation to reinstate the child’s eligibility.

- Void Marriages: Some marriages are considered “void” by law, typically due to age or family relation restrictions. If a child’s marriage is deemed void, they may retain dependent status under the VA’s rules.

- Historical Exception (Pre-1990): For certain cases, if a marriage was legally terminated before November 1, 1990, the child might still qualify as a dependent. This is an unusual exception and applies to specific cases outlined by the VA.

It’s important to keep the VA informed of any changes to a child’s marital status, as a marriage, divorce, or annulment can directly impact benefit eligibility.

Age Requirements

As stated earlier, the VA generally considers children as dependents if they are under the age of 18, unless they are 18 and 23 years old and enrolled in an approved educational institution (such as a college or vocational program). Veterans must submit documentation to the VA, such as proof of enrollment, which typically needs to be updated each year to maintain this benefit.

To qualify, the child must be enrolled full-time in an educational institution recognized by the VA. Part-time students generally do not qualify. The VA reviews the child’s educational status annually, so it’s essential to update the VA with enrollment verification at the start of each academic year. If the child discontinues their education before reaching 23, the veteran should promptly notify the VA to avoid overpayments.

Retroactive and Backpay Benefits for Veterans with Dependent Children

It’s common for the VA to issue retroactive backpay benefits to veterans. This typically occurs when there’s a delay in verifying a service-connected condition or when the VA increases the disability rating. Since VA pay rates change yearly, the monthly amount for retroactive benefits often differs depending on the specific period covered.

For example, if a veteran receives a 30% rating in 2024 with a dependent spouse and one dependent child, their monthly benefit for that rating and family status is $632.31. However, if benefits are backdated to January 2022, the rate would differ, as 2022 benefits were calculated at an earlier rate. Veterans with backpay should ensure the correct amounts are applied for each relevant period, taking into account rate changes over the years. If you have questions, contact your regional office.

Avoiding Common Errors with VA Disability Pay Rates

To ensure the highest possible compensation, veterans should:

- Confirm they’re rated for all military service-connected conditions.

- Check that their dependent status and effective dates are up to date.

- Monitor each backpay period to verify that the correct rates are applied.

- Update dependent documentation promptly if there are any changes in marital status, age, education status, or disability status of dependent children.

A VA disability lawyer can help you manage your updating requirements as well as ensure that you’re receiving the benefits you’re entitled to.

How Perkins Studdard Can Help You Maximize Your VA Disability Benefits

The VA’s guidelines for disability compensation and dependents can be complicated. This is one of the many reasons why Perkins Studdard is committed to guiding veterans through this process to secure the benefits they deserve. Our VA-accredited attorneys are experienced in reviewing disability claims, verifying ratings and dependents, and ensuring that all eligible benefits are received.

If you have questions about your VA disability compensation rate, dependents, or backpay entitlements, our team is here to help. Schedule a no-obligation consultation by calling us at 770-285-1198 to discuss your disability claim today.

Related:

Understanding the Veterans Disability Rating System: What You Need to Know